If you are 65 or older, are you leveraging the Medicare Medical Savings Accounts (MSA)?

By Greg O’Brien, Andersen Alumni Supporter

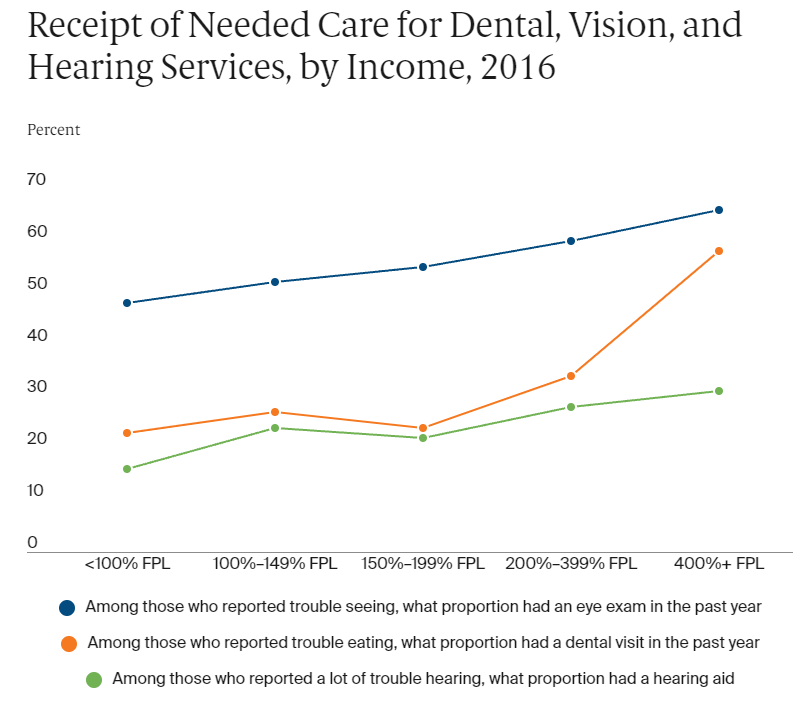

Medicare continues to grow, and that growth is accompanied by potential alterations to the program. Of increased interest is the proposal to include dental, vision, and hearing aids, which has been analyzed and considered for many years. In addition, the federal government has been looking at allowing Medicare negotiating authority regarding prescription drug pricing; capping seniors’ out-of-pocket expenses for prescriptions; and promoting a shift to long-term care in a patient’s home vs. nursing home care. According to a 2018 survey, among Medicare beneficiaries, 75% of people who needed a hearing aid did not have one; 70% of people who had trouble eating due to their teeth’s condition did not go to the dentist in the past year; and 43% of those who had trouble seeing did not have an eye exam in the past year. Lack of access was particularly acute for the disadvantaged. Of those with supplemental insurance that covered these services, 60% of their costs were still paid out-of-pocket.

Supplemental Medicare & Medicare Advantage Overview

Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of out-of-pocket healthcare costs not covered by Part A (hospital) and Part B (medical). After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for services. Medicare Advantage plans offer an alternative way to receive your Medicare benefits through a private, Medicare-approved insurance company. They must include all of your Original Medicare benefits, which includes Medicare Part A and Part B coverage (with the exception of hospice care), but may offer other benefits not included in Original Medicare.

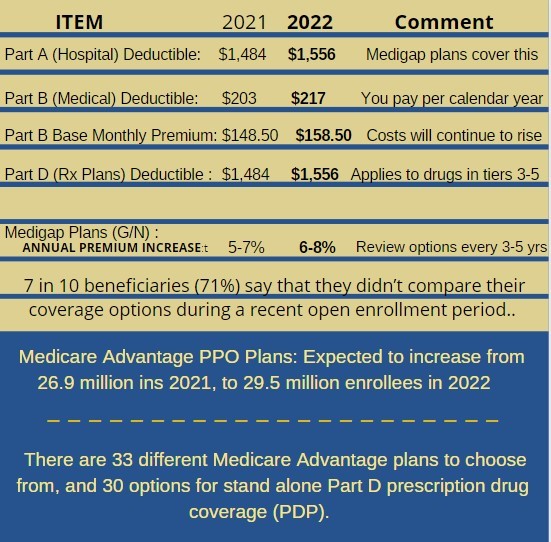

Medicare Advantage plans will continue to offer a wide range of additional benefits in 2022, including eyewear, hearing aids, dental benefits (preventive & comprehensive), fitness benefits, worldwide emergency/urgent coverage, and more. Medicare Advantage plans have strict enrollment periods. If your doctor leaves the network, you don't have the benefits you want, or you don't like your plan for any other reason, you'll most likely need to wait until the next enrollment period to change your coverage. It’s also important to know you may not be able to switch to a Medigap plan in the future without incurring penalties. Enrolling in Medigap should take place within the 6 months following your 65 th birthday. Medigap insurance companies can often accept or reject your application based on your health, so if you have pre-existing conditions, you may not be able to purchase a Medigap plan later on down the road. Whether you enroll in a Medigap policy or a Medicare Advantage plan, you must continue paying your Part B premium. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. (Medicare imposes surcharges on higher-income beneficiaries, known as IRMAA (Income Related Monthly Adjustment Amount, which has 5 earnings brackets.)

Projected Changes for 2022:

Determining which Medicare insurance strategy is best for you and your loved ones takes knowledge, experience, and thoughtful analysis. If you would like to better understand your Medicare options, please contact Greg O’Brien, Managing Principal of Medicare Caddy, LLC.

Direct email: greg.obrien@medicarecaddy.com or 470-567-3763