If you are 65 or older, are you leveraging the

Medicare Medical Savings Accounts (MSA)?

By Greg O’Brien, Andersen Alumni Supporter,

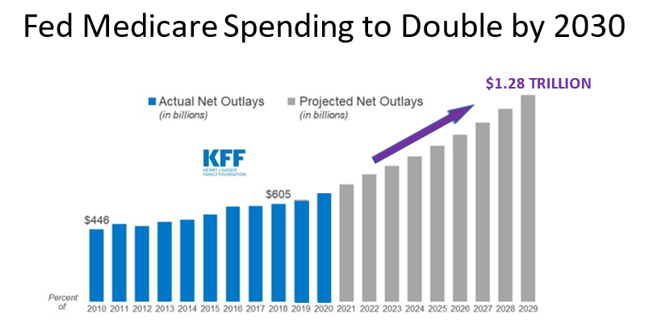

There is widespread agreement that the U. S. Federal Government’s

financial support of the Medicare health insurance system is in great jeopardy (see

chart below.) With federal spending on

Medicare projected to double to $1.3 trillion by 2030, innovative plans to “bend

the rising cost curve” have been enacted. Similar to Health Savings Accounts,

but Only for Medicare Eligibles, Medicare MSA are now offered in 36 states and

membership has increased by 76% in 2020.

The introduction of a new type of Medicare Advantage option named Medicare Medical Savings Account (MSA) is designed to appeal to the 30+ million Americans who have chosen Health Savings Accounts (HSA's) as a way to save income tax advantaged funds today – for healthcare costs in the future. The time has arrived for making people accountable for what they spend on healthcare services. Costs and benefits financial analyses by Medicare Caddy show that the vast majority of Medicare eligibles with low to moderate utilization of annual healthcare services would benefit financially by enrolling in a Medicare MSA plan.

How to Get Tax-Free Healthcare Money from Medicare?

Medicare MSA plans are similar to HSA’s in that

income tax-free savings are permitted to pay for a wide assortment of Qualified

Medical Expenses (QME). But instead

of contributing your own tax-deductible money as in the HSA model, the federal

government, through Medicare, actually gives you a tax-free lump sum of

$2,000 - $3,000, deposited into your Medicare MSA account.

You are then provided a no-fees debit card from a

major bank which you can use for Medicare medical costs or any Qualified Medical

Expenses (QME). The most attractive

benefit of the Medicare MSA is that you can “roll-over” unused funds from year-to-year

to build a tax-advantaged Medical Savings Account (Medicare MSA). Save tax-free funds today for future healthcare

needs.

If you currently have unused funds saved in a Health Savings Account, the Medicare MSA makes even more sense as the MSA funds would grow tax free, untouched, until your HSA balance is depleted. For many, this may be years down the road.

Who is Eligible for Medicare MSA?

As one plan type of the highly regulated Medicare

Advantage program, Medicare MSA plans are only available to those enrolled in Original

Medicare, which consists of Hospital Insurance (Part A) and Medical

Insurance (Part B).

Hence, your 65th birthday or upon leaving an employer health plan is the right time to evaluate the Medicare MSA with all other Medicare insurance options. The Medicare MSA option should be compared with the traditional option of purchasing a Medigap “supplemental” insurance plan as well as the numerous Medicare Advantage HMO and PPO options.

Annual Review of Medicare Insurance Options is Wise

Be aware that all Medicare insurance options are outstanding

values for the 65 million Americans who receive Medicare benefits. With our federal government subsidizing approximately

70% of all Medicare spending, all options are good. But

federal funding is subject to change – and change is always coming to the

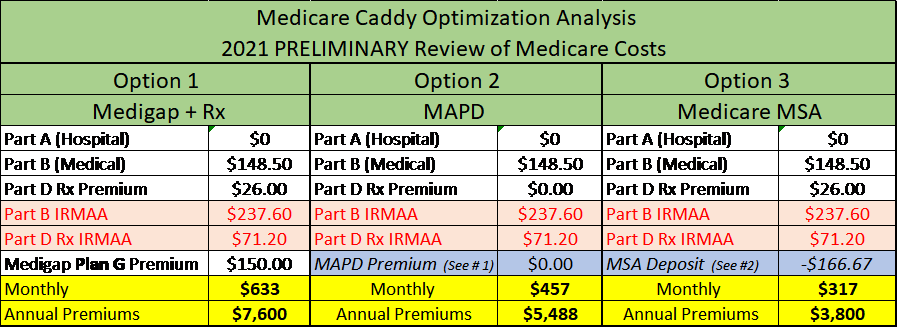

Medicare program. Below is a simple illustration comparing a few current

options:

Notes:

#1: Many

Medicare Advantage PPO plans offer $0 monthly premiums.

#2: The

Medicare MSA “premium” is actually the Annual Deposit given by Medicare. This

example reflects a $2,000 Annual Deposit, paid upfront, divided by 12 months =

$166.67

Determining which Medicare insurance strategy is best for you and your loved ones takes knowledge, experience, and thoughtful analysis. If you would like to better understand your Medicare options, please contact Greg O’Brien, Managing Principal of Medicare Caddy, LLC. Direct email: greg.obrien@medicarecaddy.com or 1-833-MDCADDY (1- 833-632-2339)