M&A

Trends and Predictions in the Accounting and Finance Consulting Markets

By

Brendan Giuseppe , Andersen

Alumnus, Founder and Managing Director of BGS Consulting and a proud sponsor of

the Andersen Alumni Association

The finance and accounting

consulting industry, like many other service providers, is facing significant

transformations, driven by evolving client demands, technological advancements,

and an ever-changing regulatory landscape. Due to the constant evolution of

client needs, mergers and acquisitions (M&A) play a vital role in enhancing

the capabilities of service providers, allowing these firms to grow, diversify

their client base, and expand their offerings. We will explore current M&A

trends in accounting and finance consulting and analyze predictions for how

current trends will shape the future of this industry.

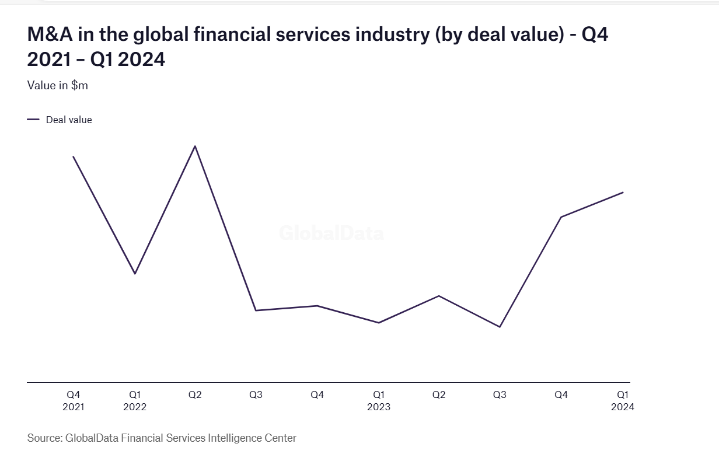

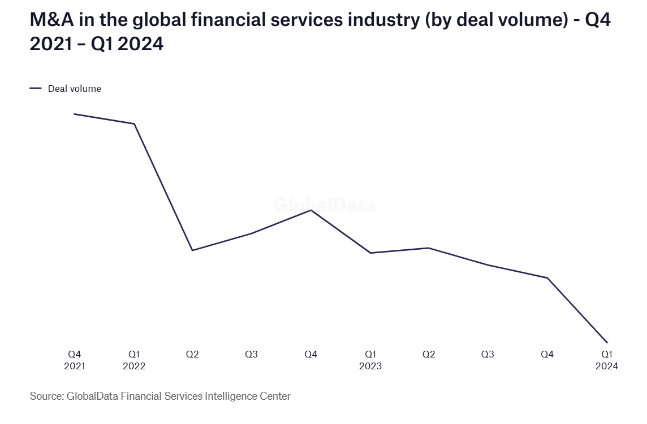

As

Q2 of 2024 ends, we see the value of M&A deals has risen by 5%, yet the

overall volume of these transactions has fallen by 30%. Amongst these

transactions, the corporate-led deals dominate significantly over private

equity. However, while the volume of transactions may have decreased and the

market still faces some economic uncertainties, deal value has remained

constant due to a few large transactions (McKinsey & Company, Morgan

Stanley). (M&A in financial services decreased in Q1 2024 -

Leasing Life)

M&A

plays a big role in the finance and accounting consulting industry as companies

are seeking to diversify their delivery capabilities. Most commonly, firms are

seeing an increase in the demand for technology-driven solutions. As such,

consulting firms want to acquire companies to integrate more advanced digital

solutions into their portfolios, such as artificial intelligence, machine

learning, and data analytics. In 2023, the number of technology-driven M&A

deals increased by 15%, with deals reaching almost $12 billion. Companies are

realizing that through the growth and expansion of the technology sector, new

software can streamline efficiency, greatly improve accuracy of processes, and

provide additional valuable insights to clients.

M&A

is also attractive to firms in this industry because these deals allow them to

expand their footprint geographically in the market, while also adding niche

service offerings to their portfolio. Larger consulting and staffing firms are

acquiring smaller players with specialized service offerings to offer a wider

variety of more tailored solutions to clients as well as to strengthen their

market positions. In 2023, there were over 200 consolidation deals between

consulting firms to grow their market presence and service offerings,

demonstrating a 10% increase from 2022. Whether the expertise is in regulatory

compliance, tax advisory, forensic accounting, technical accounting, financial

restructuring, or financial planning, these specialties can expand a firm’s

client base and greater support the needs of its clients with more tailored

solutions.

Another

contributing factor to the M&A market in the finance and accounting

consulting industry is private equity investments. M&A is seen as strategic

and valuable for accelerating growth in private equity-backed companies. In

2023, PE-backed transactions in the accounting and finance consulting sector

totaled $18 billion, marking a 25% increase from 2022. While the banking

environment remains unfavorable with high borrowing costs, private equity will

remain a particularly strong strategy for companies looking to grow and

acquire.

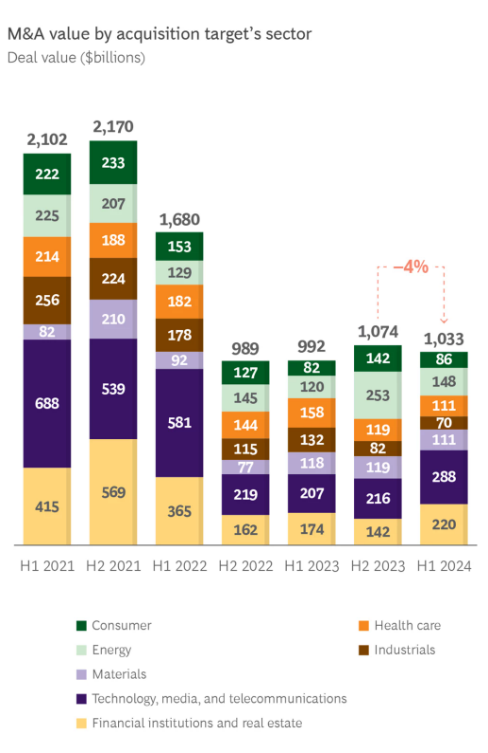

As

we look into the future of M&A, the consensus is optimistic for the

regeneration of M&A in H2 2024, after reaching a low in Q4 of 2023. The

lowering of inflation and stabilization of interest rates is expected to have a

large impact on the regeneration of the M&A market, already demonstrated by

the 4% increase we have seen in deals since the end of 2023 in the financial

institutions industry. In the next 18 months, the inflation rate is expected to

decrease, just shy of reaching the Fed’s target range of 2.0-2.5%. By the

year’s end, the market is expected to see a total transaction value of $2.69

trillion. Throughout the remainder of 2024, it is expected that the US

corporate M&A volume will increase 20%, and volume of PE transactions will

rise 16%. (M&A Market Insights Series | H1 2024 | BCG)

With

the current rate of growth in the technological sector and the shift towards

digital transformation, this trend is expected to intensify. As digital

transformation and automation solutions become more sought-after, M&A

activity will focus more heavily on acquiring firms with innovative digital and

automation solutions, predicting that by 2025, M&A in this market will grow

by 30%. In the finance and accounting industry, this includes software

platforms that assist with anything from financial planning and analysis,

robotic process automation for mundane, repetitive tasks, or AI analytics for

predictive insights for companies.

In

other efforts to diversify their service offerings, finance, and accounting

service providers will expand into adjacent markets as they continue to grow

and increase revenue. These markets could include IT consulting, cybersecurity,

or human resources, as these all frequently overlap with financial data and

accounting processes. Expanding into these complementary areas allows service

providers to address a broader range of client needs. The volume of

cross-industry M&A is anticipated to increase by 20% over the next two

years.

With

the lowering of inflation, interest rate stabilization, and strategic desire

for companies to grow, finance and accounting consulting and staffing firms are

positioned for significant transformations from the future of M&A. The

current trends of technology integration, consolidation for strategic

positioning, focus on increased specialized expertise, and private equity

investments are helping to shape this landscape. Service providers that

leverage these trends and strategically pursue M&A opportunities to expand

their capabilities are well poised for innovation and long-term growth.

BGS Consulting is a professional services firm that specializes in providing flexible, tailor-made solutions to our clients. BGS Consulting provides highly experienced finance and accounting resources to fill the project-based and strategic needs of its clients. Our team has a blend of public accounting and operational experience across numerous industries which allows us to collaborate, design and deliver unique solutions to our clients.