New Medicare

Medical Savings Accounts (MSA) Growing in Availability and Popularity

Medicare insurance is

confusing, complex and constantly changing.

As of September 2019, there were almost 21 million Medicare Advantage

enrollees, about one in three of the 62 million Medicare beneficiaries. However, according to CMS enrollment data, less

than 7,000 have a Medicare Medical Savings Account plan. But that number is about to change in a big

way.

Thanks to an insurance company

named Lasso Healthcare, millions of American seniors across 26 states

will now be able to evaluate and choose this very different approach to

managing healthcare expenses.

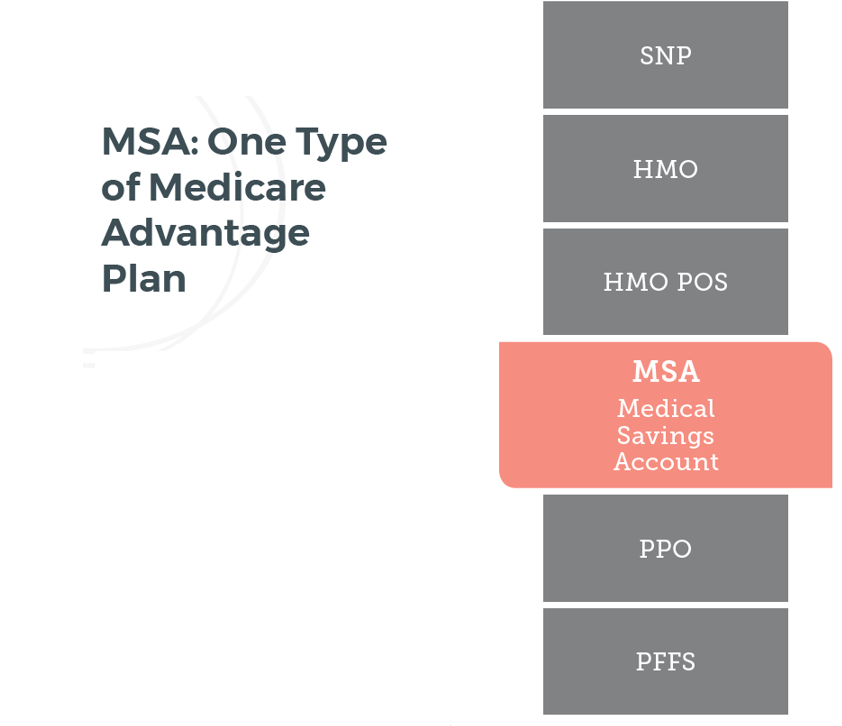

What

is an MSA?

- Highly

Regulated Plan Created by Center for Medicare & Medicare Services

(CMS)

- Financial

Investment Tool with Medicare Advantage health plan

- Consumer-Directed

Medicare Benefits

- Perfect

for Using Accumulated HSA Balances

An MSA is

similar to the popular health savings account (HSA). However, instead of your

client contributing tax-free to their account, a lump sum is deposited annually

into a medical spending account by the plan via Medicare. For Lasso MSA enrollees, the amount deposited

in 2020 will be $3,240. Members have the

flexibility to spend their balance on qualified health expenses (hospital and

medical costs, dental, vision, and long-term care to name a few), or save

it for future costs.

In addition to the

savings account, Lasso MSA members are enrolled in a high-deductible health plan, which means nothing is covered until

that deductible is met. But statistics

show that the vast majority of Medicare beneficiaries will have significant MSA

deposit money left over at the end of the year. So, the real value of an MSA is that

any money not used from that annual deposit will roll over year after year. And it grows tax-free and withdrawals are

also tax-free when used for qualified medical expenses.

While MSA plans can’t

cover prescription drug costs, MSA enrollees are able to shop and choose the

one best suited for their needs from the dozens of stand-alone Part D prescription

drug plans.

Who

Should be Most Attracted to Medicare MSA plans?

Millions of healthy and

health-conscious seniors who are aware that the need to save for future

healthcare costs is greater than to be overprotected for the near term. The Center for Medicare & Medicaid

Services wants people to be more accountable and responsible in what they spend

on healthcare – and to entice them with upfront monies that can be saved and

invested tax free to pay for the inevitable future medical expenses.

Health Savings Accounts (HSAs) a

Bellwether for Growth of Medicare MSA Plans

At the end of 2018,

approximately 25 million non-Medicare Americans had Health Savings Accounts

(HSA) along with a high-deductible health plan.

According to many financial advisors, the “triple tax-advantaged” funds

in the HSAs compete favorably with IRAs and 401k plans as retirement investment

vehicles. But once enrolled in any part

of Medicare, the ability to contribute additional funds to an HSA ends.

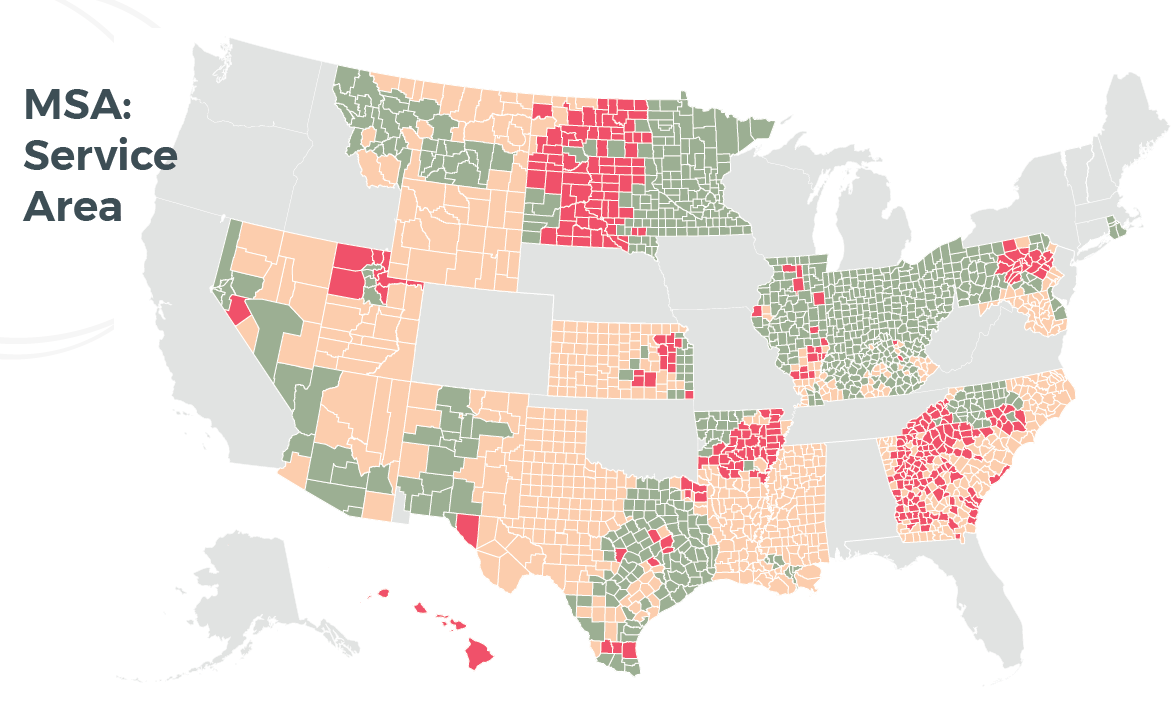

The rapid acceptance of

employer sponsored HSA plans bodes very well for the growth of Medicare Medical

Savings Accounts (MSA). In 2018, MSA

plans were only available in portions of two states (New York &

Wisconsin). The Lasso Healthcare MSA

launched in 17 additional states in 2019 and, for 2020, Lasso is expanding the

MSA offering to millions of Medicare beneficiaries living in 26 states and

Washington DC.

Other

Attractive Reasons to Like Medicare MSA plans

- $0 Monthly Premium

- No Provider Networks to Deal With

- Pay Only the Medicare Approved

Amounts for Services

By law, MSA plans cannot charge a monthly

premium and they cannot limit Members to using a network of doctors, hospitals

or other healthcare providers. This combination of $0 premium and the ability

to see any Medicare provider in any location seems to take the most attractive

elements of many Medicare Advantage plans as well as the “freedom of choice”

offered by Medigap plans. And the cost

for Medicare Parts A & B services is always at the lower of the actual cost

or the Medicare approved amount.

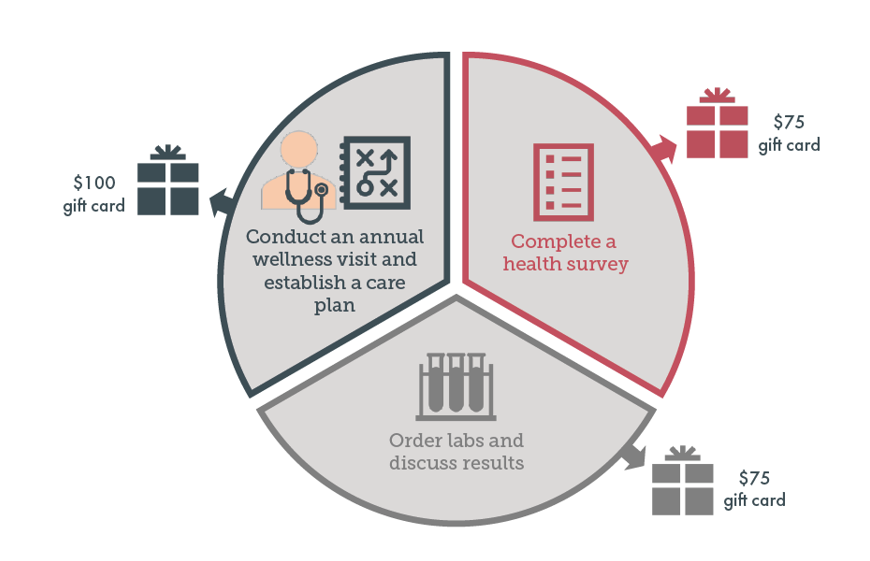

Additionally, to support the wise

use of preventative care services, the Lasso MSA plan offers an additional $250

in gift cards for completing (optional) an annual wellness visit, a health

survey and screening lab tests.

The

High Deductible Concern About MSA Plans

- What If There is an Accident or

Serious Illness?

- How Much is the Deductible?

- Can I Insure Against Paying the

Deductible?

While it takes a serious accident

or illness to meet the deductible, the annual deposit already accounts for a

chunk out of that threshold. The funds

saved in the MSA should be used to pay for costs related to Medicare Parts A

and B but can be used tax-free for hundreds of Qualified Medical Expenses (QME). The deductible amount various by region but

will be either $7,400; $8,400; or $9,400 during 2020.

Once the deductible is met, all

Medicare hospital and medical expenses are 100% covered until the following

calendar year, when the deductible is reset, and a new deposit is received.

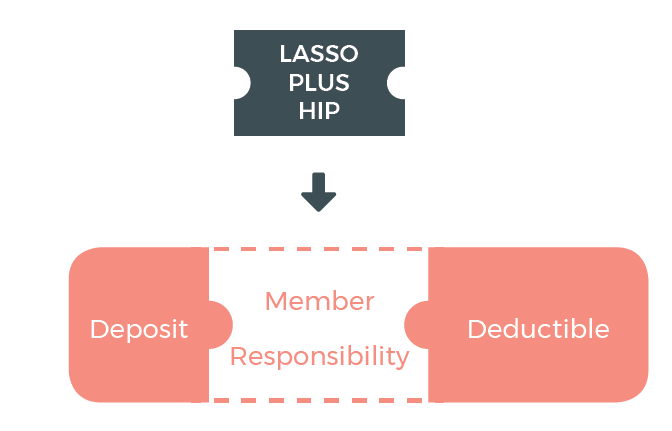

The difference between the Deductible

and the Deposit is referred to as the Member Responsibility. For Region 1 enrollees in the Lasso MSA, the

Member Responsibility would be $7,400 less $3,240 = $4,160. While it may take two or three years of

unused deposits to save an amount equal to the Member Responsibility, Lasso

Healthcare also offers a companion hospital indemnity plan (HIP) should an

adverse health event happen in the first few years before the MSA balance is

sufficient to cover the Member Responsibility.

Closing Thoughts About Medicare

Many experts predict that the

rising costs of healthcare for the enormous Baby Boom generation with greater

longevity will cripple the U.S. federal budget that pays for Medicare, Social

Security and Medicaid. The only proven

way to slow this down is to incentivize Americans to save more money to pay for

future healthcare costs. By having to

spend their own money, people will be much more prudent in how they spend it.

Medicare Medical Savings Account

(MSA) plans are a major step in that direction.

Ask your Medicare insurance agent

and/or financial advisor for their thoughts about Medicare MSA plans.

Reference Andersen Alumni for a

FREE Telephone Review of Your Medicare Options, including the Lasso MSA plans,

call 404.821.1886

Greg O’Brien is Managing Principal

of Medicare Caddy, LLC. Based in

Atlanta, GA, Medicare Caddy is a licensed insurance agency specializing in all

forms of Medicare related insurance.

Medicare Caddy has helped hundreds of people evaluate Medicare options and

enroll in the plans that optimize their Medicare benefits.

Greg can be reached by email at greg.obrien@medicarecaddy.com, phone 404.821.1886 or visit https://www.medicarecaddy.com/andersen-alumni-association