Zombie

SPACs and Bloodbaths

By John Kahn, Partner, CFGI and former Audit & Business Advisory Experienced Manager, Arthur Andersen.

You may have heard about the massive spike in popularity of SPACs, but have you heard about Zombie SPACs and Blood baths? Writing this in Atlanta, Georgia, home of “The Walking Dead” TV Show, makes it easier to appreciate that a “Zombie SPAC” is a SPAC without enough life left to deSPAC. In the same vein, so to speak, a “Blood Bath” is what the founders of a Zombie SPAC can be described as facing if their SPAC liquidates without completing its deSPAC transaction.

If

the above is confusing, going back to basics may help. A “special purpose

acquisition company” (SPAC), or “blank check company,” is a shell company that

raises capital from investors via an IPO. The investors receive a share and

some portion of a warrant in return for their $10 per share. (SPAC IPOs

traditionally go out at $10 per share with

$11.50 per warrant). The capital

raised through that IPO is held in escrow until the SPAC finds, obtains

shareholder approval for, and completes a merger with an existing operating

company (known as a deSPAC target), via a deSPAC transaction. A SPAC has up to

two years to find and complete a merger with a deSPAC target. The cost of the

search is funded by the sponsor of the SPAC. At the closing of a deSPAC Merger,

the SPAC’s investors are entitled to redeem their shares in return for getting

back their original $10 per share plus their pro-rata portion of any interest

accrued on the escrow account, while keeping their warrant. The investors also

get their money back at the end of the two-year life if a deSPAC merger

transaction has not been consummated.

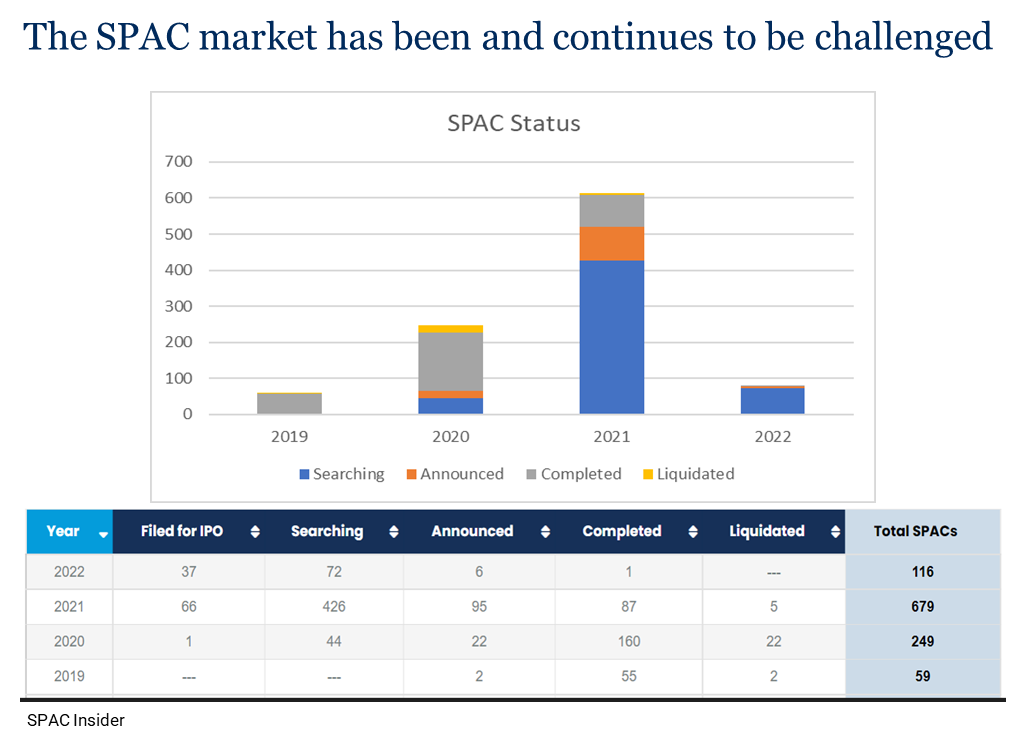

SPACs have been around for many years and spiked in popularity once the COVID-19 pandemic arrived. Large profitable companies that were overdue for a traditional IPO and more than ready to go public were some of the first operating companies to become deSPAC targets in the recent swell of deSPAC transactions. However, more recent operating company deSPAC targets, that haven’t been as large, profitable, or ready to go public, have found that the process of being acquired by a SPAC can be challenging, particularly as time has gone by and the market environment has changed significantly. This has contributed to a large number of SPACs not yet having completed their deSPAC transaction, as can be seen in the chart below, which shows the current status, by number of SPACs, of each year’s cohort of SPACs that at least filed for an IPO in the year noted.

One of the biggest challenges for the SPACs and their deSPAC targets has been that the “growth at any cost” mantra that had been driving market value was replaced in late Q1 2022 with the market demanding and valuing profitability far more highly than growth. With this sea change, redemptions at closing of deSPAC mergers spiked, as investors near-unanimously voted to redeem their shares, a number of agreed transactions were terminated and the prospects of SPACs becoming “Zombie SPACs” with “Blood Baths” for their sponsors became very real.

A

challenge that lengthens the time for which a SPAC could be a Zombie SPAC and

end with a Blood Bath, is that ideal operating company deSPAC targets need to

both have a profitability focus ahead of growth, and also already be public

company ready. This includes historical financial statements uplifted to meet

Public Company Accounting Oversight Board (PCAOB) standards and SEC

requirements; auditors who meet PCAOB standards of independence (or else

re-audits will be required which take extra time); corporate governance that

meets listing exchange requirements; adequate internal controls and/or full

disclosure of risks and uncertainties in the Form S-4 and/or other registration

statements; and more, including potentially new computer systems and/or cyber

security overhaul and upgrades, plus not to forget the need to be able to immediately

fully meet all SEC reporting requirements starting at completion of the agreed

merger.

If that sounds like too much to ask, you’d be right and it often is, at least without help from your and your audit firm(s) new best friends at CFGI. CFGI is happy to help in all aspects of deSPAC transactions, including advanced readiness work to make an operating company more attractive to potential suitors with a limited remaining life.

CFGI has deep experience project managing the whole deSPAC process, as well as the disparate individual work streams, which can also substantially benefit with assistance from, or even effectively outsourcing to, CFGI, such as: SPAC due-diligence work; helping deSPAC targets select new auditors, if needed; assisting with uplift of historical and going forward financial statements to PCAOB standards and SEC requirements; audit and/or re-audit preparation assistance; SEC registration statement drafting assistance, including pro-forma financial statement preparation; internal control development and documentation to meet public company audit and SOX requirements; assistance with remediating significant deficiencies and/or material weaknesses; new computer systems selection and implementation; cyber security reviews and upgrades; plus more.

The more part can include interim services executives and/or managers, such as Chief Financial Officer (for bandwidth expansion, or until a permanent new hire is recruited and on-boarded), Chief Accounting Officer, Head of internal Audit, Vice-President Finance, Vice-President Financial Planning & Analysis, Controller, Director of Technical Accounting and SEC Reporting. Also, interim augmentation of other gaps in the team, including in respect of alleviating excessive demands on existing team members, otherwise leading to higher staff turnover.

Advance preparation will be ever more important as SPACs get closer to their life expiring. What can be a three to nine month process will need to be shortened as much as possible and the way to do this is by getting everything that possibly can be, buttoned up ahead of time. A prime example in this regard is by using auditors that meet PCAOB independence standards and ensuring that all potentially relevant historical financial statements have been uplifted to PCAOB standards. This is in order to make it as easy as feasible to complete a deSPAC transaction as quickly as possible.

Benefits

for an operating company of going public via a deSPAC transaction, instead of

using a traditional IPO to obtain the desired public currency and liquidity,

include: not having to undertake a roadshow; setting the transaction price at

the start instead of at the end of the process; potentially a quicker path to

going public; a more flexible capital structure and ability to retain control;

access to sponsors with expertise (“gray money” rather than just “green

money”); and, at least before the SEC proposed rule changes, a frequently used

ability to include financial projections.

These benefits though won’t necessarily outweigh the current market challenges, which indicates there will be more Zombie SPACs and Blood Baths in the coming months. Indeed, some SPACs already have or are seeking shareholder consent to “throw in the towel” and liquidate early in order to minimize their Blood Bath by stopping their search sooner rather than later and not waiting out the full two years. More recently, the new US 1% excise tax on share buybacks that kicks in from January 1st, 2023 may also affect SPAC redemptions and/or liquidations. Proposed regulations are awaited from the IRS, but some SPACs may act in Q4 2022 to make that a non-issue.

Not everything is negative. There have been successful SPACs, and also SPACs that didn’t do as badly as traditional IPOs when the market turned. Common themes for success have included: strong operators, with a specialized focus; value-added strategic partners; and SPAC process expertise. CFGI helps with the SPAC process expertise, even to the extent of being called upon mid-process to “pick up the pace.”