The most important transaction of your life requires the most deliberate plan.

Building a successful business is a monumental achievement, but the eventual sale is often the most significant financial event an entrepreneur will ever face. Too often, owners wait until an offer arrives, missing years of critical preparation time that could have maximized their value and mitigated taxes.

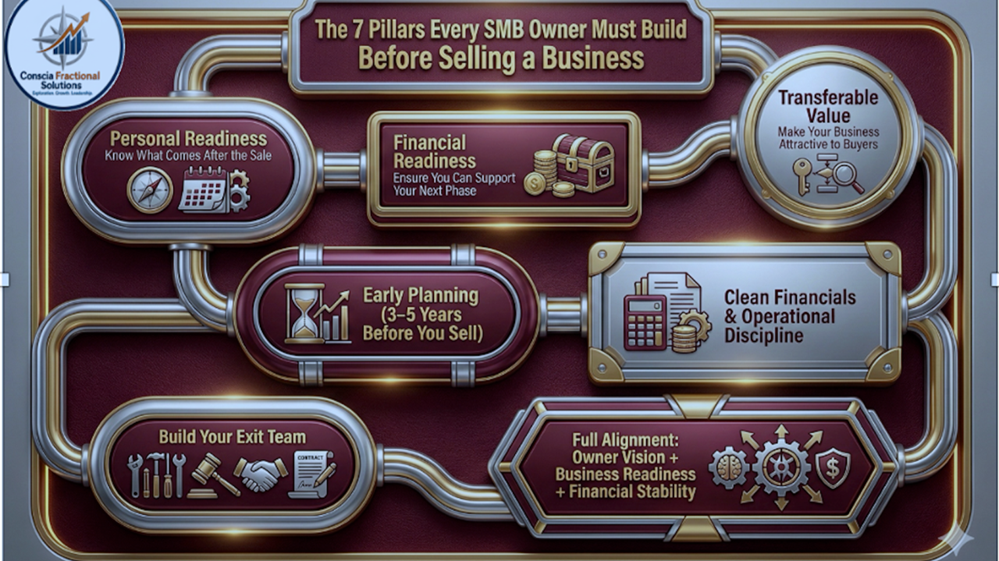

Pillar 1 Personal Readiness: Know What Comes After the Sale

The financial value of a sale is only useful if it supports your life goals. This pillar focuses on defining your "why" before you focus on the "how."

- Highest Priority: Define Your "Why" and Use a Personal Financial Plan. Get brutally honest about your motivations for selling (freedom, a new venture, retirement) to strengthen your position in negotiations. Work with your financial advisor to quantify the net proceeds you need to live the life you want. This becomes your financial target, or your "number."

- Important: Assess Your Wealth Surplus. Determine how much wealth, if any, will be left at the end of your life after meeting your financial goals. This factor informs and unlocks the potential for advanced tax mitigation strategies.

Once your personal compass is set, you can align your financials to meet your goals, which brings us to Pillar 2...

Pillar 2 Financial Readiness: Ensure You Can Support Your Next Phase

Tax mitigation and long-term wealth strategy are the core elements here, designed to maximize your take-home proceeds and secure your future.

- Highest Priority: Implement Pre-Transaction Tax Mitigation Strategies. There are far more opportunities to save in taxes before a transaction than after. Starting early allows you to use sophisticated strategies like gifting and strategic structuring to preserve more of your business value. Work with your team to conduct a Tax Mitigation Analysis to model the potential tax savings of each strategy.

- Important: Develop a Post-Sale Wealth Preservation Strategy. Once the sale proceeds are received, the focus shifts to strategic asset allocation, investment management, and legacy planning to ensure your wealth lasts and continues to grow according to your long-term values.

These financial foundations need years to mature, emphasizing the importance of Pillar 3...

Pillar 3 Early Planning (3-5 Years Before You Sell)

This is the window for strategic positioning, ensuring you have the maximum leverage when it's time to sell.

- Highest Priority: Establish Investment Banking Relationships Early. Developing rapport with investment bankers months or years in advance provides invaluable guidance on market conditions and helps you identify which parts of your business require strengthening to appeal to buyers.

- Important: Commit to a Proactive Sale Process. A proactive sale, led by a seasoned investment banker, involves strategically creating competitive buyer tension to optimize price, terms, and cultural fit. This is always superior to reacting to an unsolicited offer.

While you plan the timeline, you must simultaneously build the core attribute buyers seek transferable value...

Pillar 4 Transferable Value: Make Your Business Attractive to Buyers

Buyers pay a premium for a business that can run without the owner. This is about transforming "owner-dependent" value into "transferable" value.

- Highest Priority: Assess and Close Sellability Gaps. A sellable business is one with clean financials, documented and repeatable systems, transferable client relationships, and a strong management team. Identify and fix any area where the business is too reliant on you—a key factor for attracting serious offers.

- Important: Prepare a Quality of Earnings (QoE) Report. Engage a CPA to conduct a QoE. This report rigorously aligns your financial statements (emphasizing EBITDA, or earnings before interest, taxes, depreciation, and amortization) to validate your earnings and financial sustainability.

Transferable Value is rooted in the meticulous detail of your operations, which requires strong operational discipline...

Pillar 5 Clean Financials & Operational Discipline

Buyers hate surprises. This pillar is about ensuring a smooth due diligence process by tidying up your legal and financial records in advance.

- Highest Priority: Get Your Legal House Ready Through Reverse Due Diligence. Hire a seasoned M&A attorney to conduct a reverse due diligence on your own company. This identifies and remedies potential issues related to contracts, IP, compliance, or ownership structures before they can reduce your value.

- Important: Ensure Financial Transparency and Consistency. Make sure your internal accounting practices are consistent, transparent, and defensible. Clean financials instill confidence, which translates directly into favorable deal terms.

No owner can tackle these complex issues alone; you need a coordinated team of specialists...

Pillar 6 Build Your Exit Team

Selling a business requires a coordinated group of specialists. Your success depends on the synergy of this team.

- Highest Priority: Establish a Financial Advisor Relationship (The Head Coach). Choose an advisor who specializes in business exit planning. They serve as the "head coach," coordinating the strategic conversations and aligning the efforts of the other professionals (CPAs, attorneys, bankers).

- Important: Assemble and Coordinate Your Core Collaborative Team. Bring together your key professionals—financial advisor, M&A attorney, CPA, and investment banker—to ensure unified, thoughtful, and coordinated advice across personal, legal, tax, and business matters.

The final pillar brings all components together to ensure your exit is executed with confidence and control...

Pillar 7 Full Alignment: Owner Vision + Business Readiness + Financial Stability

This is the final checkpoint, ensuring all parts of your plan are in harmony and preparing you for the crucial negotiation phase.

- Highest Priority: Develop a Protocol for Handling Unexpected Buyer Inquiries. Decide in advance how you will vet the buyer, control the flow of confidential information (a slow reveal), and manage the initial conversations to protect your leverage and value.

- Important, but Lowest Priority: Learn Negotiation Basics. While your investment banker will lead the process, a basic understanding of deal flow and common buyer tactics will help you stay calm and avoid being surprised when the stakes get high.

Your Next Step

Exit planning doesn't need to be overwhelming. The best time to start is now, taking the highest priority action in each of these pillars.